Gusto payroll calculator

Try it for Free. Ad Heartland Makes Payroll Easy with Margin-Friendly Pricing for Your Business.

Switch Your Payroll Provider To Gusto S People Platform

Automatic deductions and filings direct deposits W-2s and 1099s.

. If you are also eligible for SSI during the 5-month SSDI waiting period use our Concurrent SSDISSI Back Pay Calculator Special note regarding tax-exempt pay. If you need to temporarily. Well do the math for youall you need to do is enter.

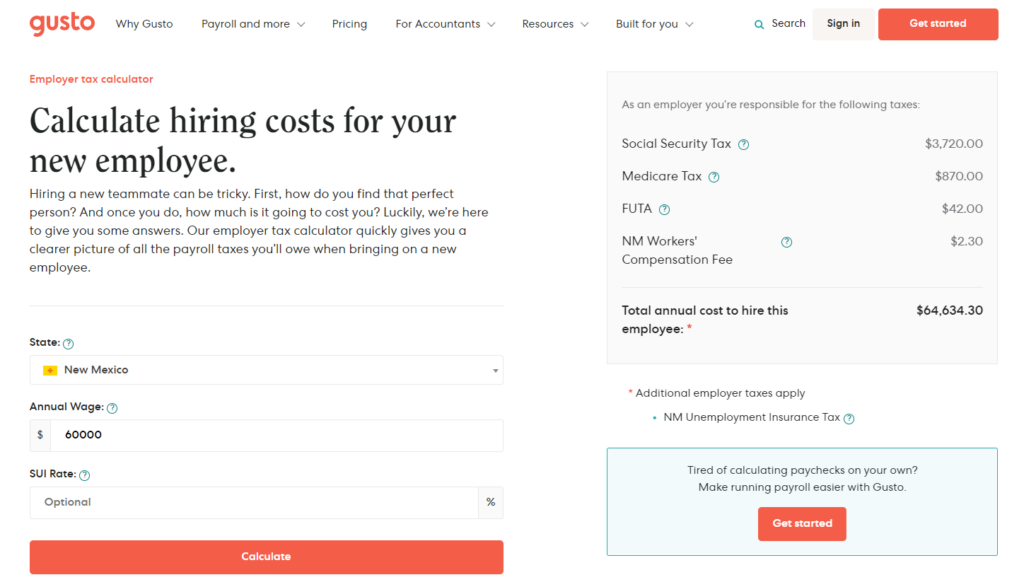

And the rest of your HR Check us out The information provided by the Employer Tax Calculator is for general information and estimation. Why Gusto Payroll and more Payroll. Get Started With ADP Payroll.

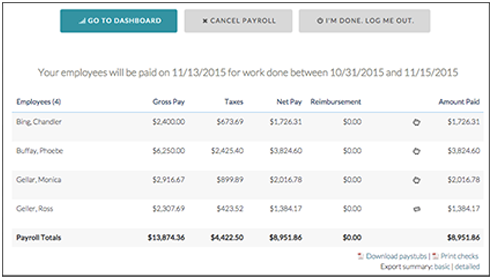

Salary Paycheck Calculator. Payroll benefits and everything else. The timeframe in which the employee worked to.

Why Gusto Payroll and more Payroll. Payroll benefits and everything else. Using the percentage method only the part of your household income thats above the yearly tax filing requirement is counted About Salary.

Easy To Run Payroll Get Set Up Running in Minutes. All Gusto accounts come with your choice of automated. Gusto is a full-service payroll and benefits platform designed to grow with US-based startups and small businesses.

Join Gusto today and dont pay a cent until youre ready to run payroll. Gustos payroll benefits and HR platform is trusted by more than 200000 businesses and their teams. Well run your payroll for up to 40 less.

Automatic deductions and filings direct deposits W-2s and 1099s. Hourly employee pay rates and custom earning types Use this article and the dropdowns below to help understand the different ways you can pay an hourly employee. Use Gustos salary paycheck calculator to determine withholdings and calculate take-home pay for your salaried employees in Florida.

If you make traditional. US Paycheck Tax Calculator We calculate how much your payroll will be after tax deductions in New Jersey This paycheck calculator can help you do the. Simple A streamlined set of automatic payroll features and benefits integrations.

Taxes Paid Filed - 100 Guarantee. Under the Other payroll options section select the Bonus Payroll tile. Use Gustos salary paycheck calculator to determine withholdings and calculate take-home pay for your salaried employees in California.

Gusto offers fully integrated online HR services. Use this this burn rate calculator to quickly see how long you have until you need to either reach profitability or raise capital. Keeping your burn rate in mind helps you prioritize where to invest.

Time off requests and. Use Gustos hourly paycheck calculator to determine withholdings and calculate take-home pay for your hourly. 40mo plus 6mo per person Create.

Taxes Paid Filed - 100 Guarantee. Ad Much more than a HR software all your HR processes in a single place. Subtract any deductions and.

This number is the gross pay per pay period. Enter a work period. Ad Run your business.

Gusto automatically calculates and syncs your teams hours PTO and holidays with payroll. Get Started With ADP Payroll. Ad Process Payroll Faster Easier With ADP Payroll.

205-921-5595 2131 Military Street S Hamilton AL 35570 View Location. Ad Process Payroll Faster Easier With ADP Payroll. Here When it Matters Most.

Customized Payroll Solutions to Suit Your Needs. Big on service small on fees. Gusto offers fully integrated online HR services.

Get your payroll done right every time. Hourly Paycheck and Payroll Calculator Need help calculating paychecks. Spend less time doing administrative HR tasks and focus on what matters.

Ad Much more than a HR software all your HR processes in a single place. Discover ADP Payroll Benefits Insurance Time Talent HR More. Salary Paycheck Calculator.

Use Gustos hourly paycheck calculator to determine withholdings and calculate take-home pay for your hourly employees in Texas. Plus we help you stay compliant with alerts software integrations and more. Ad Payroll So Easy You Can Set It Up Run It Yourself.

Well do the math for youall you need to do is enter the. To calculate a paycheck start with the annual salary amount and divide by the number of pay periods in the year. Spend less time doing administrative HR tasks and focus on what matters.

Simply enter their federal and state W-4 information as. Try it for Free. See how simple Gusto makes payroll.

Discover ADP Payroll Benefits Insurance Time Talent HR More. Click the Payroll section and select Run payroll.

Gusto Review Pcmag

![]()

Zenefits Vs Gusto Which Hr Software Is The Winner For 2022

Gusto Com Payroll Solutions Hire Pay Insure Support Your Team

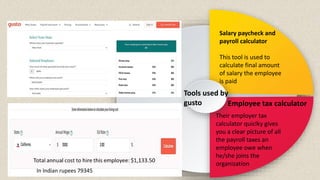

Presentation On Gusto Payroll

Gusto Formerly Zenpayroll Time Tracking Made Easy Quickbooks

10 Best Free Payroll Calculator In India Fy 2021 22 Paycheck Calculator

Payroll Tax Calculator For Employers Gusto

Top 5 Hourly Paycheck Calculator Can Make Your Life Easy

A Time Tracking System That Works With Gusto Payroll Ontheclock

Different Types Of Payroll Deductions Gusto

Free Payroll And Hr Resources And Tools Gusto

![]()

Zenefits Vs Gusto Which Hr Software Is The Winner For 2022

How To Calculate Payroll Taxes In 5 Steps

Gusto Payroll

Presentation On Gusto Payroll

The 14 Best Payroll Software Solutions For Small Businesses

Payroll Tax Calculator For Employers Gusto